Nine Entertainment Holdings (ASX:NEC) has performed well in the stock market, with its share price up a whopping 15% over the past three months. As most of us know, fundamentals are usually what guide long-term market price movements, so look at the key financial metrics of today’s companies to see if they play some role in recent price movements. We decided to determine whether it was fulfilling. Specifically, we decided to examine Nine Entertainment Holdings’ ROE for this article.

Return on equity or ROE is an important metric used to assess how efficiently a company’s management is using the company’s capital. In other words, it shows that we have succeeded in turning shareholder investment into profit.

Check out the latest analysis from Nine Entertainment Holdings.

ROE calculation method

ROE can be calculated using the following formula:

Return on Equity = Net Income (from Continuing Operations) ÷ Shareholders’ Equity

Therefore, based on the above formula, Nine Entertainment Holdings’ ROE would be:

15% = A$315 million ÷ A$2.1 billion (based on the last 12 months to June 2022).

“Revenue” is the income a business earned in the last year. One way he conceptualizes this is that for every A$1 of share capital held by the company, the company made a profit of his A$0.15.

Why ROE Is Important to Profit Growth

So far we have learned that ROE is a measure of a company’s profitability. Depending on how much of these earnings a company reinvests or “holds” and how effective it is, a company’s potential for revenue growth can be assessed. All else being equal, companies with both high return on equity and high profit margins typically have higher growth rates compared to companies without the same capabilities.

Nine Entertainment Holdings revenue growth and 15% ROE

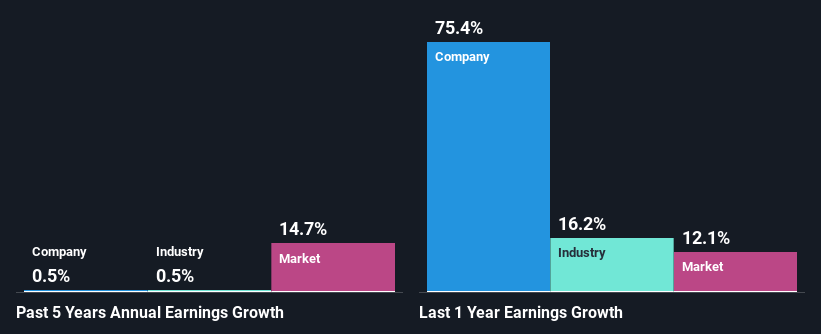

First, Nine Entertainment Holdings’ ROE looks acceptable. Moreover, the company’s ROE is very good compared to the industry average of 9.5%. Given this situation, one can’t help but wonder why Nine Entertainment Holdings has seen little to no growth over the past five years. So there could be some other aspects that could potentially hinder the company’s growth. For example, the company may have a high payout rate or the business may have an insufficient capital allocation.

Second, comparing Nine Entertainment Holdings’ net profit growth to the industry, we find that the company’s reported growth matches the industry’s average growth rate of 0.5% over the same period.

The foundation for adding value to a company is largely tied to revenue growth. It is important for investors to know whether the market is pricing in a company’s expected earnings growth (or decline). This helps determine whether the stock is positioned for a bright future or a dark future. If you’re in doubt about Nine Entertainment Holdings’ valuation, check out this gauge of its price-to-earnings ratio relative to the industry.

Is Nine Entertainment Holdings making good use of its profits?

With a high three-year median dividend yield of 91% (meaning the company only retains 9.4% of the business’s earnings to reinvest in the business), most of Nine Entertainment Holdings’ profits go to its shareholders. is paid. Lack of revenue growth.

Additionally, Nine Entertainment Holdings has paid dividends for eight years. According to existing analyst estimates, the company’s future payout percentage is expected to drop to 70% over the next three years. However, the company’s ROE isn’t expected to change much as the projected payout ratio declines.

Conclusion

Overall, Nine Entertainment Holdings’ business appears to have some positive aspects. Against the backdrop of high ROE, the company has grown profits moderately. But the business holds little profit. This could have a negative impact on the company’s future growth. That said, looking at current analyst estimates, we do know that the company’s earnings are expected to gain momentum. Are these analyst expectations based on broader industry expectations or company fundamentals? Click here to go to our analyst predictions page for the company. increase.

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

Participate in Paid User Research Sessions

you $30 USD Amazon Gift Card An hour of your time while helping build better investment tools for individual investors like you.SIGN UP HERE